The Foreign Workers Handbook (Downloadable PDF)

I Labor Contracts

1) Application of labor laws and regulations to foreign nationals

As a general rule, Japanese laws concerning labor apply to all employees in Japan, regardless of nationality. It means that the Labor Standards Law, the Minimum Wages Law, the Industrial Safety and Health Law, the Workmen’s Accident Compensation Insurance Law, the Employment Security Law and others also apply to foreigners.

The Labor Standards Law stipulates that the employer shall not engage in discriminatory treatment with respect to wages, working hours or other working conditions by reason of nationality or other status of any worker. (Article 3, Labor Standards Law)

2) The Principles of Labor Contracts

In the past, there have been many problems such as wages not being paid as promised or a penalty being deducted from wages on retirement. To prevent these troubles relating to labor contracts, the Labor Standards Law stipulates the following

matters;

(1) Working conditions must be stated clearly. The employer shall clearly state the working conditions when a labor contract is drawn up. The following matters shall be written and handed to the employee.

① The period of the labor contract.

② The working place and job duties.

③ Existence of overtime work.

④ The time at which work begins and at which work ends, breaks, days off, and holiday and leave.

⑤ The amount of wages, the methods of computation and payment, the date of closing accounts and of payment.

⑥ Matters pertaining to retirement.

The employee may immediately cancel the labor contract, if the working conditions as clearly stated differ from actual fact. (Article 15)

Therefore, it is advisable for the employee to obtain a written contract, rather than an oral one. When the contract is made, the employee must examine the contents of the contract. In cases where employees cannot understand their contracts written in Japanese, it may be possible to have them translated into their own languages. It is also desirable to check the details of the rules of employment which are laid down by the company.

(2) A contract violating the Labor Standards Law is invalid.

A labor contract which does not meet the standards of this law is invalid with respect to such portion. In such a case the sections which are invalid are governed by the standards set forth in the Labor Standards Law. (Article 13)

(3) Period of Contract

① Labor contracts shall be made for a period of no longer than three years except for those without a definite period. However, a contract may exceed three years wherein the period for completing a specified project is determined.

② It is also permissible to draw up a contract of up to five years in cases where an employee has highly specialized knowledge/skills, or, employee is aged 60 years or above. However, an employee with a contract for a defined period (other than those who were contracted for a specific period to complete certain projects, or who fall into item ②) may resign at any time after fulfilling the first contract year, by submitting his/her request of leave to the employer.

With regards to the extention, renewal, or cancellation of a contract with employees of defined working periods, employers must clearly state the basis of the decision made.

(4) Stating Reasons for Dismissal

In concluding a labor contract, employers must clearly state “Reasons for Dismissal” in writing.

(5) Ban on Pre-determined Indemnity

An employer cannot make a contract which fixes in advance either a sum payable to the employer for a breach of contract or an amount of indemnity for damages. (Article 16)

For example, matters such as the following cannot be fixed in the contract: the amount of damages for breach of contract because an employee quits before his/her contract expiration date; compensation payable to the employer if an employee damages machines, etc.

However the employee is still under an obligation to pay damages if he/she inflicts a loss on the firm because of his/ her serious mistake.

(6) Ban on Offsets Against Advances

An employer should not offset monthly wages against advances of credit made as a condition for work. (Article 17)

(7) Ban on Compulsory Savings

An employer cannot require a contract for compulsory savings. However, it is possible for the employer to take charge of employees’ savings entrusted to the employer by the employees. But the employer should conclude a written agreement with them and submit it to the Labor Standards Inspection Office. (Article 18)

3) Rules of Employment

(1) The Rules of Employment

Rules of employment stipulate working conditions and office regulations. Any company which employs 10 or more workers on a steady basis must provide such rules of employment, and submit them to the Labor Standards Inspection Office. The company is also required to make these regulations known to the employees. It is therefore desirable for employers to do so in a language that their employees understand, if they do not understand Japanese.

Rules of employment shall not infringe any law and any collective agreement. A labor contract, in which the working conditions are inferior to the rules of employment standards, shall be invalid. In such a case, the parts of the contract, which are invalid, shall be governed by the rules of employment standards.

(2) Items of Rules of Employment

The following items must be stated in the rules of employment;

① Matters pertaining to the time at which work begins and at which work ends; rest periods; rest days and leave; and matters pertaining to the change in shifts,

② Matters pertaining to the methods of determination, computation and payment of wages (excluding extraordinary wages), the date of closing accounts and of payment and increases in wages,

③ Matters pertaining to retirement (including reasons for dismissal).

Others are;

i) in the event that there are stipulations for retirement allowances, extraordinary wages and safety and health, matters pertaining to such items,

ii) in the event that there are stipulations for having employees bear the cost of food and other such expenses, matters pertaining to such items.

II Wages

1) Principles of Payment of Wages

In the Labor Standards Law, ‘wage’ means the wage, salary, allowance, bonus and every other payment to the employee from the employer as remuneration for labor, regardless of the name by which such payment may be called. (Article 11, Labor Standards Law)

When drawing up a labor contract, the employer must state clearly matters concerning wages and hand a statement to the

employee. (Article 15)

The Law also stipulates the principles of payment of wages in order to ensure that the wages are handed to the employees as follows; (Article 24)

① Wages must be paid in cash except in cases provided for by law or ordinance, or by union agreement.

② Wages must be paid directly to the employees themselves

③ Wages must be paid in full. Partial deduction may not be permitted with the exception of taxes, social insurance

premiums and others according to the written agreement.

④ Wages must be paid at least once a month on a definite date, except extraordinary wages such as a bonus, etc.

2) Guarantee of Wages and Minimum Wages

As wages are the most important matter for employees’ life, the Labor Standards Law stipulates guaranteed payment as

follows;

① In the event of suspension of business for reasons attributableto the employer, the employer should pay an allowance equal to at least 60 % of the employee’s average wage. (Article 26)

② With respect to employees employed under a piece-work system or other sub-contracting system, the employer should

guarantee wages at a fixed amount proportionate to hours of work. (Article 27)

③ In the event an employee requests the payment of wages to cover emergency expenses for illness, accident or other

emergency cases, the employer should pay accrued wages prior to the normal date for payment. (Article 25)

④ The employer cannot hire an employee for less than the minimum wage, stipulated by the Minimum Wages Law. (Article 28)

The minimum wage in Tokyo is ¥719 per hour as of Oct.1,2006.

In addition to this, minimum wages are given in each industry.

⑤ Claims for wages, accident compensation and other claims will lapse if not made within two years; and claims for retirement allowances will lapse if not made within five years. (Article 115)

3) Decreases in wages as sanctions

A company may “decrease wages as a sanction” in order tomaintain discipline at the firm. This is different from deducting

wages which amount is according to the hours of lateness or absence. The company should state the details about decreases as sanctions in the rules of employment.

In the event the rules of employment provide for a decrease in wages as a sanction against an employee, the decrease for:

① a single deduction shall not exceed 50% of the daily average wage and

② the total amount of decrease shall not exceed 10% of the total wages for a single pay period. (Article 91, Labor Standards Law)

4) If companies go bankrupt and the wages haven’t been paid.

In an event that a company goes bankrupt and it fails to pay its employees, there is the system in which the government advances the employees’ wages on behalf of the company. This is based on the Security of Wage Payment Law “( CHINKAKU – HO”).

(1) Person eligible to receive Replacement Payment

① When a company which has been engaged in business activities for a year or more goes bankrupt, and the employee

has been laid off from the company, without being paid. This system does not apply when the total of unpaid wages is less

than ¥20,000.

② Employees who have retired from the company on a day within a period from six months before the bankruptcy to two

years thereafter as counted from the day when the bankruptcy was filed with the court (in the case of “Bankruptcy in

Law”), or the day for application as a bankruptcy in fact to the Labor Standards Inspection Office (in the case of “Bankruptcy in Fact”).

“De facto bankruptcy” is only applicable to small and medium-sized companies, wherein the Labor Standards Inspection Office recognizes that a business has become defunct with no chance of reestablishment and is unable to pay wages, even though bankruptcy has not yet been filed. This is limited to small and medium sized companies only.

(2) Unpaid Wages subject to Replacement Payment

① Subject to replacement payment is the unpaid sum of the regular wages and the retirement allowance which should be

paid during the period from the date 6 months before the resigration to the day before the claim date. Extraordinary wages or discharge notice allowances shall not be subject to the payment.

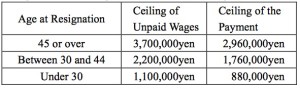

② The limit of replacement payment is the amount of 80% of the unpaid wages and the ceiling is shown in the following

table:

Please contact the Labor Standards Inspection Office on procedures regarding payments made on behalf of failed companies.

5) Annual Salary System

The annual salary system is the pay system in which a company decides the annual lump payment of its employee(s) by

evaluating as a whole the ability, work achievements, potential, and so on, of the subject employee.

Companies are also to pay overtime pay to employees in this system. Even if a given amount of overtime pay is already

included in an annual salary, unless the breakdown of that salary is stated (e.g.: Annual Salary of XX yen; Extra Pay of XX yen, etc.), employers are obliged to remunerate overtime work separately. Also, if a worker has worked more hours than

pre-designated, the employer must compensate the difference.

III Working Hours, Holidays and Annual Leave

1) Legal working hours and holidays

Legal working hours per week are 40 hours. The Labor Standards Law stipulates that an employer shall not make an employee work more than 8 hours per day. The fixed working hours of each firm shall not be longer than the legal hours.

(Article 32)

However, up to and including 44 hours of work per week are allowed as a special case in the business categories of commerce, cinema and theater, health and sanitation and service and amusement, where there are fewer than 9 regular employees in the company or business.

Many kinds of modified working hours systems which can accommodate working hours to business fluctuations are also

allowed under specified conditions. (For instance; One month unit modified working hours system, One year unit modified

working hours system and a flex-time system.)

With regard to holidays, Labor Standards Law stipulates that an employer shall provide employees with at least one holiday per week. Otherwise an employer can provide at least four holidays during a four week period. (Article 35)

With regard to breaks it stipulates that an employer shall provide employees with at least 45 minutes of break time when

they work over 6 hours, and 1 hour of break time when it is over 8 hours. (Article 34)

2) Overtime work and work on holidays

So-called a “36 Agreement” (A written agreement about overtime work and work on holidays) should be concluded between an employer and employees and submitted to the Labor Standards Inspection Office, when the employer wants to extend

working hours or have an employee work on holidays. The employer should pay increased wages for such work. (Article 36,

Labor Standards Law)

The rate of increased wages for overtime work and night work (defined as being during the period between 10 p.m. and 5 a.m.) is an increase of at least 25%. The rate for work on holidays is an increase of at least 35%.

An employer is not under obligation to pay increased wages for overtime work, if working hours per week during a modified

period or a settlement period are not over the legal working hours, in cases where the company is under the modified working hours system. If you do not understand the method of calculation of hours and pay, you should ask your company.

3) Annual Paid Leave

The Labor Standards Law stipulates the annual paid leave system so that employees may take leave at any time and enjoy a pleasant life.

“An employer shall grant annual paid leave of ten working days, either consecutive or divided up into portions, to employees

who have been employed continuously for 6 months calculated from the day of hiring and who have reported for work on at least 80% of the total working days.” (Article 39)

Part-timers can also take annual paid leave depending on the number of their working days, even if their fixed working days

are relatively few. Even though the contract period of employment is for one month or 3 months, if employees have worked for more than 6 months as a result of renewal of contacts, they may take annual paid leave.

The number of paid holidays is as follows:(as of April,2006)

Employees can take annual paid leave whenever they want. However, a company is allowed to change the requested leave day to another period of time, if the company’s normal operations would be prevented by the requested leave.

Paid holidays can be taken within 2 years from when it was allowed, but employees cannot take it after the day of their

resignation.

Preplanned Grant of Annual Paid Leave

In the event an employer, pursuant to a written agreement with either a labor union or with a person representing a majority of the workers, has made a plan with regard to the period of time in which leave with pay, the employer may grant paid leave in accordance with such plan. However, employees are able to use atleast 5 days out of their preplanned grant of paid leave, freely.

4) Maternity Leave and Child Care Leave

Expectant female employees can take 6 weeks (14 weeks for twins or more) of maternity leave before childbirth and 8 weeks

after giving birth (Article 65, Labor Standards Laws). Female employees who are nursing an infant of up to 12 months are also

entitled to take nursing time twice a day, each for at least 30 minutes aside the legally allowed break times. They can take

nursing time by showing up 30 minutes late or leaving work 30 minutes early, or take 60 minutes off at one time (Article 67,

Labor Standard Laws).

As no law stipulates the payment of wages during the leave period, companies should make clear whether they pay or not in

their rules of employment or other form. In cases of unpaid leave, the employee can still receive about 60% of her normal wage during maternity leave as maternity allowance from the Health Insurance (Please refer to Health Insurance Benefits on p.69 for maternity-related allowances).

Any employee, either male or female, who is rearing an infant of up to 12 months of age, is also entitled to childcare leave. In

cases in which they face difficulty rearing because they are unable to enroll their child in a daycare center/facility, and suchlike matters, they can extend their leave until the child becomes one and a half years old (Article 2 and 5, Child Care and Family Leave Law). Employees on a fixed-term employment contract who have been consecutively employed for one year or more, and are expected to be employed continuously well after the child turns one years old, can take child care leave (Article 6, ChildCare and Family Leave Law).

They receive about 30% of their wages during childcare leave from the Employment Insurance if they meet given prerequisites.

When they come back to work after taking the leave, about 10% of their wages are paid in a lump sum according to their

childcare leave period. With prior application, they are exempted from paying social insurance premiums during childcare leave.

5) Family Care Leave

Employees who take care of a family member requiring full-time care are entitled to family care leave. The leave can be

taken up to 93 days in total per subject family member. Employees on a fixed-term employment contract, who have been

employed for one straight year or more, are eligible for family care leave, if they are expected to be employed continuously well after returning from their leave of 93-days. (Article 2 paragraph 2, Article 11 paragraph 1, Article 15 paragraph 1, Child Care and Family Leave Law).

As no law stipulates the payment of wages during the leave period, companies should make clear whether they pay or not in

their rules of employment or other form.

During family care leave, an employee can receive about 40%of the wages as the benefit from the Employment Insurance if

he/she fulfills certain conditions.

Companies must establish measures similar to child care leave, or reduce working hours for employees who waive their right to take child care leave or are raising children aged between one and three years (Article 23, Child Care Leave and Family

Care Leave). (Please refer to Principles of Labor Contract on p.2).

IV Resignation and Dismissal

1) Resignation

The Labor Standards Law stipulates that an employer shall not force workers to work against their will (Article 5). Therefore an employee may give up his/her job whenever he/she wants to, but it should be done under the social rules.

Rules (and steps) in resigning differ according to whether or not the employment contract states a specified/fixed period of

time.

(1) Contracts for a specified period;

In cases where the employee is contracted to work for a specified period of time, he/she should resign when the period of contract expires and the contract of employment will be terminated.

Resignation during the specified contract period is not allowed in principle without any proper, unavoidable reason (Article 628, Civil Law). In cases where the contract prescribes regulations concerning resignation, the employee should follow

these. It is possible that compensation for damages due to non-performance of obligation may be claimed by the company. An example would be in a case where an employee suddenly quits, regardless of regulations concerning advance notice in the contract, and the company is damaged by his/her early resignation.

Some companies or employers include in their labor contracts an obligation for the employee to pay penalty fees if a contract is broken, such as a resignation in the middle of a labor contract. Such a rule is invalid, however, because the rule is

against Article 16 of the Labor Standards Law which stipulates a “Predetermined Indemnity”.

(2) Contracts without a fixed period of employment.

When an employee submits his/her resignation to the company at least 2 weeks before his/her resignation, the contract shall be terminated, if his/her contract is without a fixed period of employment, and if no special matters about resignation are stated in the rules of employment. However, according to the law, monthly salaried workers are required to give notice of

resignation in the first half of the current salary period, if he/she wishes to resign at the beginning of the next salary period.

(Article 627, Civil Law)

It is advisable to speak with the company in advance in order to effect a smooth handing over of duties on resignation.

2) Dismissal

Dismissal is when an employer unilaterally terminates a labor contract with an employee before its pre-determined expiration

date. The Labor Standards Law stipulates that“ dismissal without objective, rational reason(s) and unacceptable by current social standards, will be considered as an abuse of power and is therefore invalid.” (Labor Standards Law, Article 18- 2)

Employees have the right to request a written notice stating the reason(s) for dismissal.

(1) Dismissal in the case of workers employed for a fixed period

Employers are not allowed to dismiss employees with a fixed period of contract before the contract expires, except for in cases with an unavoidable reason (Article 628 Civil Law), or when a company goes bankrupt (Article 631 Civil Law).・・・・ Even though in such a case dismissal would be unavoidable, the employer is responsible for compensation payable to the employee if the unavoidable reason is due to any fault attributable to the employer.

Dismissal may be allowed if an employee breaks any of the regulations laid out in the labor contract.

(2) Dismissal in the case of employees not employed for a

specified period

A company may terminate contracts without a specified period of employment according to Article 627 of the Civil Law, but according to the Labor Standards Law, minimum standards should apply as follows:

① An employer shall provide at least 30 days advance notice if the employer wishes to dismiss an employee. If an employer fails to do so, he/she must pay the average wages for a period of not less than 30 days in lieu of advance notice of dismissal. The number of days of advance notice may be reduced by the number of days for which the employer pays average wages. (Article 20)

② Even an employee in a probationary period shall be given advance notice as above, when the person has been employed

consecutively for more than 14 days. (Article 21)

③ The exceptions are;

(1) if continuance of the enterprise has been made impossible by a natural disaster or other unavoidable cause (excluding failure to pay tax or financial difficulties), (2) when the reason is attributable to an employee, and an employer previously applies and obtains the approval of the Labor Inspection Office for an exception of dismissal notice. In this case, the employer is able to dismiss the employee without notice or compensatory payment. (Article 20)

④ An employer shall not dismiss an employee during a period of recuperation from injuries suffered in the course of duty nor within 30 days thereafter. However, after 3 years in recuperation the employer is able to dismiss an employee if the employer pays compensation for termination, or when the continuance of the enterprise has been made impossible by a natural disaster or other unavoidable cause (the employer should obtain the approval of the Labor Standards Inspection Office) (Article 19).

⑤ The employer cannot discharge a woman during her maternity leave nor within 30 days thereafter (Article 19).

Furthermore, as dismissal is very serious for employees, the court ruled that a valid reason must be given for dismissal when the company wishes to discharge employees against their will, and dismissals which lead to an abuse of authority are not

allowed.

Even when a dismissal is due to a reduction in personnel because of a business decline, it needs to satisfy the following

requirements.

① the reduction in personnel is necessary for the company’s existence and maintenance,

② the company has made efforts to avoid dismissals by not hiring new employees or by encouraging early retirement,

③ the basis of the reduction in personnel is rational and also equitable, and persons must be selected logically.

④ the company has also made efforts to explain to the employees’ satisfaction the rationale of staff reductions and the necessity of dismissal.

3) Termination of Consecutive Employment (Rejection of

Contract Renewal)

In cases of labor contracts with a specified period, termination comes with their expiry. However, the so-called“ termination of consecutive employment” has become a serious problem. This is where a contract with a specified period has been renewed several times and a company has continued to employ an employee for a certain period, only to suddenly terminate the contract (upon its expiration) and displace him/her.

Several measures are stipulated as follows, to avoid such trouble upon contract expiration.

1. Employers are to clearly state the renewal or cancellation of contracts, and the criterion for contract renewal.

2. Employers are to give at least 30 days prior notice when terminating contracts for employees who have been employed for over one year on a contract for a specified period.

3. When employees request a clear statement on the reason(s) for the termination of their employment, employers must comply promptly in writing.

4. When a fixed-term contract employee, who has already been employed for over one year through contract renewal, arrives at a new contract term, the employer must make an effort to extend the contract period as much as possible, according to the substantiality of the contract and employee’s wishes.

Past judicial precedents [concerning legal conflict involving contract termimnation] show that some contract terminations were recognized depending on certain surrounding elements (e.g., objective overview of business, procedures and realities of

contract renewal, etc.) as seen as a whole by the court.

V Labor Unions

1) Organization of a Labor Union

Foreign employees have the right to organize a labor union, bargain and act collectively, in order to keep and improve their working conditions. The organization of a labor union and its activities are guaranteed as basic labor rights by the Constitution of Japan and the Labor Union Law stipulates these rights in detail.

The Labor Union Law stipulates that the requirements of a labor union that can be protected by the law (Article 2, Labor Union Law). are as follows: a labor union shall be;

① composed mainly of employees

② formed autonomously

③ for the main purposes of maintaining and improving working conditions and raising the economic status of the employees.

As a labor union is a kind of group, any employee can organize one freely at any time with the minimum of two members. There is no need to gain consent from the company. It is fine as long as a labor union is organized independently and operated democratically by the employees.

However it is desirable that a labor union be formed by as many employees as possible in order to carry out its functions.

2) Formation of a Labor Union

Most labor unions in Japan are company ones. Some unions are formed by industry or region, not by company. For instance;

joint labor unions, which in principle members can join individually, and industrial unions which are formed by employees who work in the same occupation.

A worker can solve problems at work by collective bargaining after joining a joint labor union as an individual, if there is no

labor union in the company, or if it is difficult to organize a labor union together with at least two co-employees. There are some joint unions providing a labor advisory service in Tokyo. The Labor Consultation Center and its offices have a list of these unions. Please ask at the office for more detailed information.

3) Activities of a Labor Union

(1) Collective bargaining

Collective bargaining is a forum for employees and employers to negotiate working conditions from an equal standpoint. A

labor union shall have the right to bargain collectively with the company for which its members work, regardless of the number

of members (Article 6, Labor Union Law).

There is no system in Japan like the exclusive negotiation representative system in the United States of America (where only a labor union that has a majority of employees is endowed with the right to bargain collectively).

An employer shall not refuse to bargain collectively without proper reasons. If so, it shall lead to an unfair labor practice (Article 7- (2), Labor Union Law).

(2) Unfair labor practice

The law prohibits an employer from infringing on employees’ rights to a union. This is an unfair labor practice. If an employer commits an unfair labor practice, an employee or the labor union is entitled to complain against such an unfair practice to the Labor Relations Commission. The Labor Relations Commission makes an investigation and hearing without delay, and if the Commission recognizes the labor practices in question to be unfair, it will issue an order to protect the employee. The following practices shall be forbidden as “Unfair Labor Practices” (Article 7-2, Labor Union Law);

① to discharge or discriminate against an employee by reason of his/her being a member of a labor union, having tried to

join or organize a labor union, or having performed proper acts of a labor union;

② to make it a condition of employment that an employee must not join or must withdraw from a labor union;

③ to refuse a request for collective bargaining without proper reasons;

④ to control or interfere with the formation or management of a labor union by employees;

⑤ to give financial support in defraying the labor union’s operational expenditure;

⑥ to treat in a disadvantageous manner an employee by reason that he/she made a complaint to the Labor Relations

Commission.